Search

Small is the new Big!

Growing at 12 to 15 per cent annually, mini construction equipment is showing that in today’s construction landscape, smaller machines can make a bigger impact.

The outlook for hydraulic excavators is promising

HD Hyundai Construction Equipment India is one of the leading manufacturers of construction and earthmoving equipment. Sharwan Agnihotri, Head – Mining & Export Business, discusses the specific features and benefits that make hydraulic excavators well-suited for the Indian market.

L&T-Komatsu Unveil Mini Hydraulic Excavator

A cost-efficient and sustainable solution for the construction industry

Hyundai CE India Advances Excavators with Cutting-Edge Features

HD Hyundai Construction Equipment is one of the leading construction and earthmoving equipment manufacturers in India. Joydeep Baksi, National Sales Head (Sales & Marketing), Hyundai Construction Equipment India, speaks on the latest advancements incorporated into their recent hydraulic excavator models.

Hyundai holds a No. 2 position in excavator attachments in India.

Joydeep Baksi, National Sales Head (Sales & Marketing), Hyundai Construction Equipment India, speaks on the current market size of hydraulic excavators in India, and how has it evolved over the past few years.

Engcon Unveils Enhanced S60 Coupler for 12-19 Tonne Excavators

The coupler includes a bolted lifting hook and also a lifting eye.

Komatsu achieves 40% productivity boost on PC900LC-11 Excavator

The new model incorporates significant design enhancements

Doosan Launches Next-Generation Wheel Excavator Lineup

Doosan Infracore North America is rolling out its next-generation -7 series wheel excavators as it continues to refresh its -5 series models.

Doosan’s first “smart excavator” – DX225LC-7X

Doosan Infracore North America has added an electronically-controlled excavator model with machine-assisted technologies to its next generation of crawler excavators in the United States.

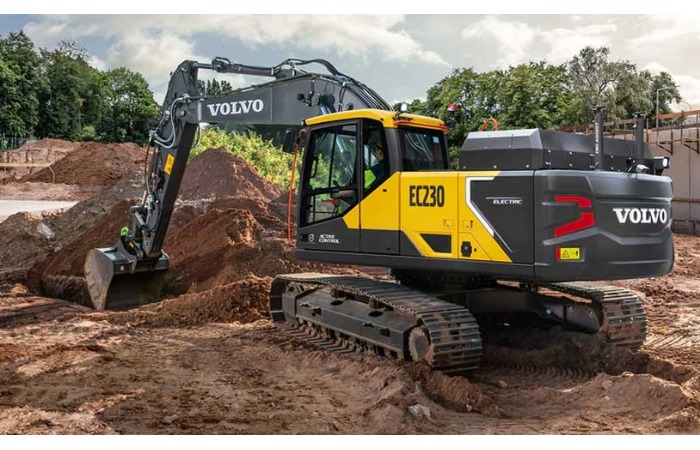

Volvo testing first large electric excavator

Taking the next step to battery power for its machine line-up, Volvo Construction Equipment has electrified its first large crawler excavator as a customer pilot.

Hyundai CE launches EU Stage V 13-15 tonne A-Series excavators

Hyundai Construction Equipment is launching three EU Stage V compliant A-Series crawler excavators in the popular 13-15 tonne sector, delivering new levels of performance, efficiency and productivity for rental companies and contractors.

SAB purchases Liebherr wheel loaders & crawler excavator

Since its foundation in 1985, SAB has invested in more than 50 Liebherr machines. New Liebherr XPower wheel loaders and an R 945 G8 are the most recent additions.

SAB purchases Liebherr wheel loaders & crawler excavator

SAB expands fleet with seven new XPower wheel loaders and an R 945 G8 crawler excavator

JCB launches new range of CEV stage IV compliant wheeled CE

JCB India launched its all-new range of CEV Stage IV compliant wheeled construction equipment vehicles. The launch of these machines makes JCB India the first company in the industry to have brought in the CEV Stage IV emission standards across its range of wheeled machines.

JCB launches new range of CEV stage IV compliant wheeled CE

The range includes the 3DX Plus and the 4DX backhoe loaders, the VM117 soil compactor, the 530-70 and the 530-110 telehandlers with engines complying with the new emission norms. For bulk handling, three new wheeled loaders, the 433-4, the 437-4 and the 455-4 were also launched with new engines.

Compact and powerful

With the growth drivers of urban and rural infrastructure markets opening up, mini construction equipment segment is looking for a renewed growth in the coming years.

MINI EQUIPMENT have huge growth opportunities IN INDIA

Bobcat is a global leader in compact construction equipment, having a wider portfolio of equipment on offer.

We are positive about the future of mini excavators

Bobcat is currently offering three models of mini excavators in India. S Manjunath, General Manager-Sales, Doosan Bobcat India, elaborates more on the product range and market opportunities.

First Liebherr R 936 excavator delivered to Elboka

SOMTP Belgium delivered the first of the new R 936 compacts in Benelux to earthmoving company Elboka N.V, in last August.

Doosan Bobcat india launches new products

At the bauma CONEXPO INDIA 2018, Doosan Bobcat India participated with an objective of increasing the awareness of the brand, its portable power products and attachments.

Wheel loader market is expected to grow by 17-18%

The wheel loader market in India has been growing at a brisk pace over the last couple of years after touching a low in FY 2015-16. The 3 to 3.5 Ton-class wheel loader market has witnessed 17 per cent growth in the FY 2017-18 till now.

Wheel loader market is expected to grow by 17-18%

We are focusing on making our wheel loaders versatile and suitable to meet various applications in roads, railways, irrigation, mining and industrial works by developing new attachments and variants, says Vivek Hajela, General Manager and Head - Construction Equipment Business, Larsen & Toubro Ltd.

The big movers

Being the major equipment class in the infrastructure development activities, Earthmoving equipment sees further demand growth in future owing to an anticipated growth in construction activities.

Excavators Excel

Driven by the infrastructure development activities in the country, hydraulic excavators recorded a sharp growth in 2016 compared to the previous year. The positive trend is continuing this year also with a 26 per cent growth in the first four months.

Back on Growth Path

Given its versatility and mobility, backhoe loader finds great use at almost every construction site, both urban and rural India. This multi-purpose machine continues to perform a variety of tasks at sites and is used for digging, dosing, levelling and lifting activities.

Product SHOWCASE

BAUMA CONEXPO INDIA 2016 was the right platform for the exhibitors to unveil their cutting-edge products, technologies and solutions. Many exhibitors launched their new technologies and products at the expo, while others showcased their industry leading solutions.

+91-22-24193000

+91-22-24193000 Subscriber@ASAPPinfoGlobal.com

Subscriber@ASAPPinfoGlobal.com